RM288.45 million in taxes from e-cigarettes since inception

The government collected RM288.45 million in taxes from electronic smoking devices, liquids and gels, both with and without nicotine since 2021 until July 2025.

In the same period, the total amount of tax collected from cigarettes is RM15.02 billion.

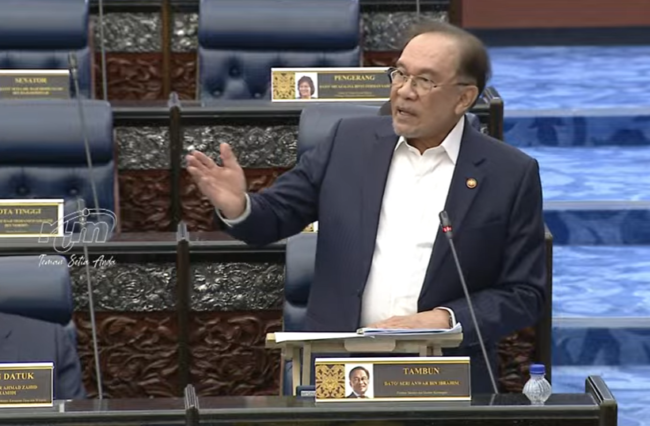

“Overall, the taxes and duties collected from both types of products amounted to RM15.3 billion from 2021 to July 2025,” said Finance Minister Datuk Seri Anwar Ibrahim.

He said this in his written reply to Datuk Wan Saiful Wan Jan (PN-Tasek Gelugor) who queried on the annual taxes collected from vapes compared to cigarettes.

Anwar also explained that previously excise duties were applied only to non-nicotine liquids and gels at 40 sen per millilitre.

“Besides that, excise duties were imposed on all devices for electronic and non-electronic cigarettes, including vapes, at an ad valorem rate of 10%, effective Jan 1, 2021.

“The scope of the excise duties was then expanded to nicotine gels and liquids used in vapes and electronic cigarettes from May 1, 2023.”

He said the 40 sen per millilitre rate was then applied to both nicotine and non-nicotine gels and liquids.

On Thursday, Health Minister Datuk Seri Dzulkefly Ahmad told the Dewan Rakyat that his ministry’s expert committee is in the midst of finalising a proposed ban on electronic cigarettes and vapes.